Failed Payment Recovery

Failed Payment Wall

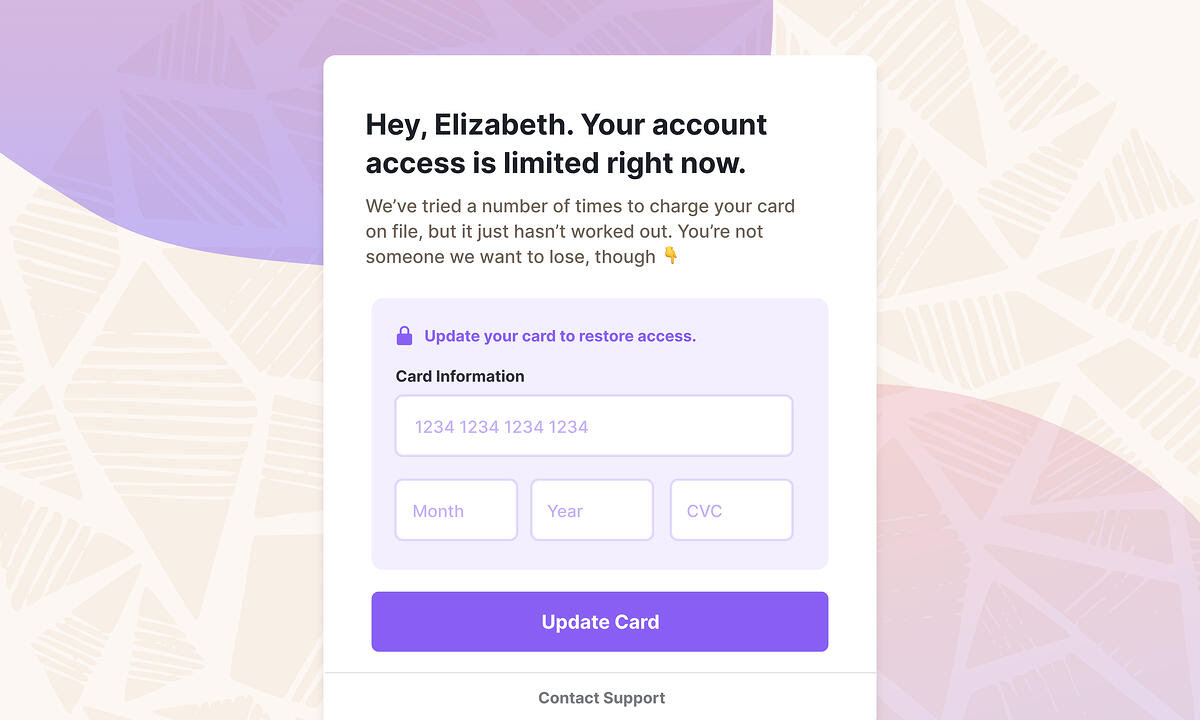

Block access to your application when payments fail

The Failed Payment Wall helps you recover revenue by automatically blocking access to your application when a customer's payment fails. It displays a streamlined UI for customers to update their payment information and immediately retry failed charges.

Currently available for Stripe only

Quick start

To implement the Failed Payment Wall:

- Ensure the Churnkey script is loaded

- Add the below code to your application initialization

- Customize the wall behavior (optional)

window.churnkey.check('failed-payment', {

// Required - Authentication & identification

customerId: 'CUSTOMER_ID',

authHash: 'HMAC_HASH',

appId: 'YOUR_APP_ID',

provider: 'stripe',

// Optional - Wall behavior

mode: 'live', // Use 'test' for development

softWall: false, // Allow users to exit the wall

gracePeriodDays: 0, // Days before enforcing hard wall

forceCheck: false, // Skip caching (not recommended)

subscriptionId: 'SUBSCRIPTION_ID' // Target specific subscription

})

How it works

The Failed Payment Wall activates automatically when:

- A customer has invoices with

openstatus in the last 60 days - Their most recent invoice is not

paid

When activated, it:

- Blocks access to your application

- Displays a payment update form

- Processes the new payment method

- Restores application access on success

Configuration

Core options

| Option | Type | Default | Description |

|---|---|---|---|

mode | string | 'live' | 'live' or 'test' environment |

softWall | boolean | false | Allow customers to exit the wall |

gracePeriodDays | number | 0 | Days to show dismissible wall before enforcing |

forceCheck | boolean | false | Bypass payment status cache |

ignoreInvoicesWithoutAttempt | boolean | false | Only show wall for failed charge attempts |

Custom display logic

Control when to show the wall based on your business rules:

window.churnkey.check('failed-payment', {

// ... other options

shouldShowFailedPaymentWall(overdueInvoice, customer) {

// Examples:

if (overdueInvoice.amountDue > 50000) {

return false // Skip for high-value invoices

}

if (customer.isVIP) {

return 'soft' // Allow VIPs to dismiss

}

return true // Show wall for others

}

})

Return values:

true- Show wall (follows softWall setting)false- Don't show wall'soft'- Show dismissible wall'hard'- Show enforced wall

Optional UI elements

Add extra buttons to the wall:

window.churnkey.check('failed-payment', {

// ... other options

handleLogout() { }, // Add logout button

handleSupportRequest() { }, // Add support button

handleCancel() { } // Add cancel subscription button

})

Event callbacks

Monitor wall activity:

| Event | Description |

|---|---|

onFailedPaymentWallActivated() | Wall is displayed |

onUpdatePaymentInformation(customer) | Payment updated successfully |

onFailedPaymentWallClose() | Wall is dismissed (soft wall only) |

onError(error, type) | Error occurred |

Error types:

FAILED_PAYMENT_WALL_INITIALIZATION_ERRORFAILED_PAYMENT_WALL_UPDATE_CARD_ERRORFAILED_PAYMENT_WALL_CANCEL_ERROR

Testing

Test the implementation using Stripe's test cards:

- Create a test customer

- Add the test card:

4000000000000341(Stripe's "Decline After Attaching" card) - Create and add a subscription item to an invoice

- Enable auto-charging for the invoice

- Finalize the invoice to trigger the failed payment

- Verify the Failed Payment Wall appears

Watch a complete walkthrough: