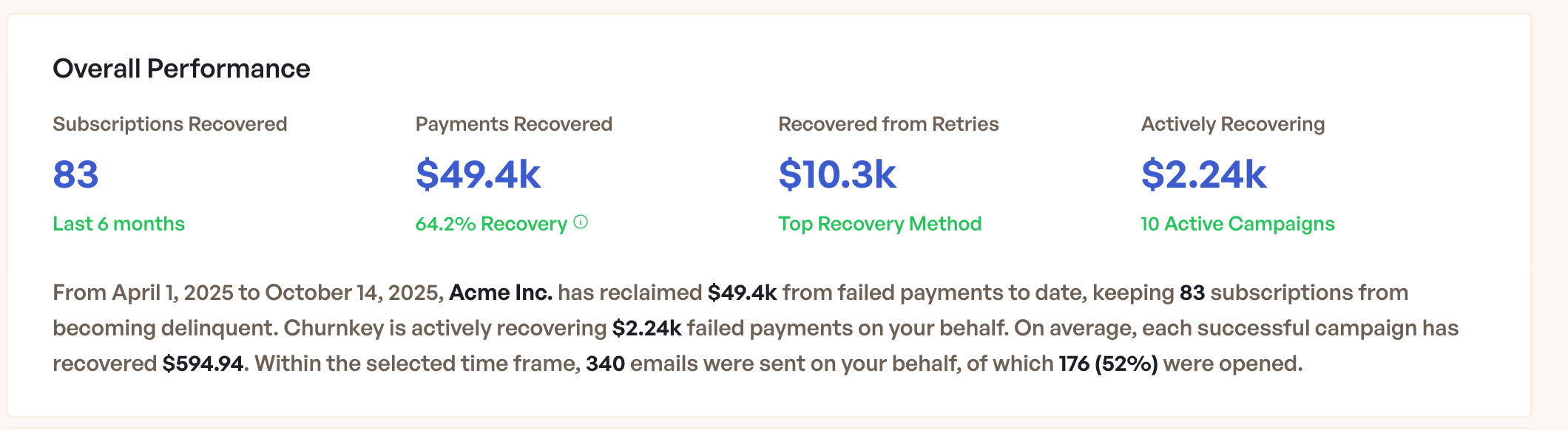

The Overall Performance section gives you a big-picture view of your Payment Recovery campaigns divided into four key insights: Subscriptions Recovered, Payments Recovered & Recovery Rate, Top Recovery Method, and Actively Recovering & Active Campaigns. The Date Picker on the top right allows you to filter all the metrics for a specific timeframe.

Subscriptions Recovered

This metric represents the total number of Successful Payment Recovery Campaigns. A campaign can be understood as the unique email sequence + retries scheduled when a failed payment happens for a certain customer's subscription.

Why It Matters

This metric shows how many times your customers failed a payment and were retained. Each recovered payment represents a customer relationship and revenue saved. Additionally, you're enabling customers to maintain their data and setup in the platform they rely on.

How It Works

A failed payment can be recovered essentially by two means: Retries or by having a customer update their Payment Method. Any failed payment recovered regardless of the method will be accounted for in the Subscriptions Recovered metric.

Each failed payment creates exactly one recovery campaign. When that campaign successfully recovers the payment, it adds one to the Subscriptions Recovered count.

Example

Example 1: Incorrect Card Number

A failed payment happened with a decline reason of Incorrect Card Number.

- We schedule the Email/SMS sequence together with Retries

- Customer receives Email/SMS, visits the Payment Method Update page, and updates their card

- The new card is successfully retried and payment is recovered

- Subscriptions Recovered increases by one

Example 2: Insufficient Funds - Auto Retry

A failed payment happened with a decline reason of Insufficient Funds.

- We schedule the Email/SMS sequence together with Retries

- Card is successfully retried by Churnkey and payment is recovered

- Subscriptions Recovered increases by one

Example 3: Insufficient Funds - Payment Wall

A failed payment happened with a decline reason of Insufficient Funds.

- We schedule the Email/SMS sequence together with Retries

- Customer visits your website, faces the Failed Payment Wall

- Updates the Payment Method, we successfully retry the card and the payment is recovered

- Subscriptions Recovered increases by one

Payments Recovered & Recovery Rate

Payments Recovered is the total amount in dollars of revenue successfully recovered from failed payments. All payments recovered in other currencies are automatically converted to the USD equivalent value based on the latest exchange rates.

The Recovery Rate, displayed below Payments Recovered, is the percentage of successful campaigns over your total campaigns scheduled.

Why It Matters

Payments Recovered is your bottom-line impact metric—the actual revenue your payment recovery campaigns have saved. This directly translates to financial impact on your business. It can be used to calculate the ROI you receive on your Churnkey subscription.

Considering a business that fits the minimum requirements of churned revenue per month, the minimum ROI we expect exclusively from Payment Recovery, excluding the Other category, is around 5 times. In our $300 subscription, it would mean $1,500 in the Payments Recovered metric.

The Recovery Rate represents the efficiency of your campaigns. It's a first indicator of whether your campaigns are well designed to incentivize customers to update their payment method. This metric is heavily correlated to the business context—for B2C companies we expect 55% or higher and for B2B companies 75% or higher.

How It Works

The total number is calculated based on every recovery source. There are currently 5 sources available:

- Emails When a customer actively clicks the email's link, visits the Payment Method Update page, then updates their card.

- SMS When a customer actively clicks the SMS link, visits the Payment Method Update page, then updates their card.

- Retries Related to Auto-retries done before every email or Precision Retries. Both retry methods are optional.

- Failed Payment Wall When a customer faces the Failed Payment Wall, then updates their Payment Method.

- Other Any action performed outside of Churnkey (e.g., 3rd party software or your Payment Provider's own retry).

Example: Payments Recovered

During a selected period, your recovery breakdown might look like:

- Emails: $3,000

- SMS: $2,000

- Retries: $4,000

- Failed Payment Wall: $1,000

- Other: $1,000

Payments Recovered = $3,000 + $2,000 + $4,000 + $1,000 + $1,000 = $11,000The Recovery Rate is calculated based on all the successful campaigns versus all the finalized campaigns. Active campaigns—those where the failed payment is still in the recovery process—are not counted in this metric.

Example: Recovery Rate

- Customer A: Failed payment recovered → Successful Campaigns = 1, Total Campaigns = 1

- Customer B: Failed payment unrecovered → Successful Campaigns = 1, Total Campaigns = 2

- Customer C: Failed payment recovery attempt still in progress (not counted) → Successful Campaigns = 1, Total Campaigns = 2

Recovery Rate = Successful Campaigns / Total Campaigns = (1) / (2) × 100 = 50%Top Recovery Method

This shows which recovery method has generated the highest total revenue (in USD) during your selected date range. It can be one of these four:

- Retries (combines both Auto Retries and Precision Retries)

- Emails

- SMS

- Payment Wall

Why It Matters

This metric reveals which recovery channel is driving the most dollar value for your business, not just the most campaigns. A method might have fewer campaigns but recover higher-value subscriptions, making it your top revenue driver. This insight helps you understand where your recovery investment is paying off most and where to focus optimization efforts.

How It Works

The system tracks total revenue recovered through each method and ranks them by dollar amount. The method with the highest total revenue wins, regardless of how many campaigns ran through that channel.

Example

During a selected period:

- Emails: 500 campaigns recovered $25,000

- Retries: 20 campaigns recovered $50,000

- SMS: 100 campaigns recovered $10,000

- Payment Wall: 50 campaigns recovered $15,000

Actively Recovering

This metric shows the total dollar amount (in USD) from failed payments that are currently in active recovery. These are campaigns where the recovery sequence is still running—emails are scheduled or have been sent, retries are pending, but the payment hasn't been recovered yet. All currencies are automatically converted to USD based on the latest exchange rates.

Why It Matters

This is your revenue at risk that can still be saved. It represents your active recovery pipeline—the real money being pursued right now through ongoing campaigns. Unlike historical metrics that show past performance, Actively Recovering gives you a real-time snapshot of recovery efforts in progress. This helps you understand the immediate financial impact of your recovery operations and the potential revenue that could convert to "Payments Recovered" in the coming days.

How It Works

A campaign is considered active when all of these conditions are true:

- A payment has failed and the recovery campaign was created

- The recovery sequence is still running (emails scheduled or sent, retries pending)

- The payment has not been recovered yet

- The campaign has not been deactivated or completed

A campaign becomes inactive and stops contributing to this metric when any of these happens:

- The payment is successfully recovered (moves to "Payments Recovered")

- All emails have been sent and all retry attempts have been exhausted

- The invoice is voided or deleted

- The subscription is canceled

The metric displays both the total dollar amount at stake and the count of active campaigns currently running.

Example

Your dashboard shows "$8,450 Actively Recovering" with "35 Active Campaigns" displayed below. This means you have 35 customers currently in the recovery process with a combined failed payment value of $8,450. Here's what might be happening:

Customer A failed a $500 payment 2 days ago. The first email was sent, two more are scheduled over the next 5 days, and three retry attempts are pending. Status: Active (contributes $500 to the total).

Customer B failed a $300 payment 5 days ago. Today, they clicked the email link and successfully updated their payment method. Status: No longer active (moves to "Payments Recovered").

Customer C failed a $200 payment 10 days ago. All five emails were sent, all retry attempts failed, and no more recovery actions are scheduled. Status: No longer active (campaign exhausted).

In this scenario, only Customer A's $500 would remain in "Actively Recovering," while Customer B's recovery adds to your success metrics and Customer C's represents an unsuccessful campaign.

Frequently Asked Questions

My metrics are below the minimum mentioned

In this case, you should contact our team via chat so we can deeply analyze your operation and understand what can be optimized. We're happy to help! Don't hesitate to reach out.